Retail Vs Residential Investment!

Residential investment has always been the preferred choice for most people, but times are changing and retail investment is gaining ground. However, there is still no clarity as to which one is better.

Presenting herewith is the comparison between the two investments based on following factors:

- Rentals: Commercial real estate or retail investments always yield higher rentals compared to residential projects. With the economy growing at a healthy rate, more and more people are turning into businessmen and hence there is a growing demand for offices, shops, and commercial establishments, which offer healthy rentals based on per square foot rather than the whole unit.

- Expenses: Residential projects require lesser maintenance charges, taxes, and other liabilities compared to commercial projects. However, higher rentals from retail projects can help to meet such expenses and in many cases, the tenants end up paying those higher charges.

- Regular Incomes: If you buy a house to lease it, the normal period of lease is 11 months. However, with commercial leasing, it is 3-10 years, which assures regular income thereby letting the investor plan their finances adequately. Also, this means that one need not look for new tenants after every 11 months, should the tenant decide to leave.

- Value of Property: If the commercial establishment is located in a growing business locality, the basic price of property will increase faster and at a higher rate compared to a residential project. The downside is if the business activity in the area declines or doesn’t grow at an expected rate, the returns, both in terms of rentals and property appreciation will be less than satisfactory. Residential investment, on the other hand, provides steady returns on a long-term basis and doesn’t show sudden spikes or falls in value appreciation or rentals

- Risk: Overall risks are higher when investing in retail property as it depends on the performance of the business district or establishment it is part of along with higher operations expenses and charges, but the returns are also comparatively higher. Residential projects involve lesser risk, especially in terms of finding a tenant since the demand for housing in the country is constantly growing as well as routine maintenance and upkeep of the property

There is no right or wrong when it comes to real estate investment. All one needs to do is decide the priority and then do diligent research before finalizing a project, whether residential or retail.

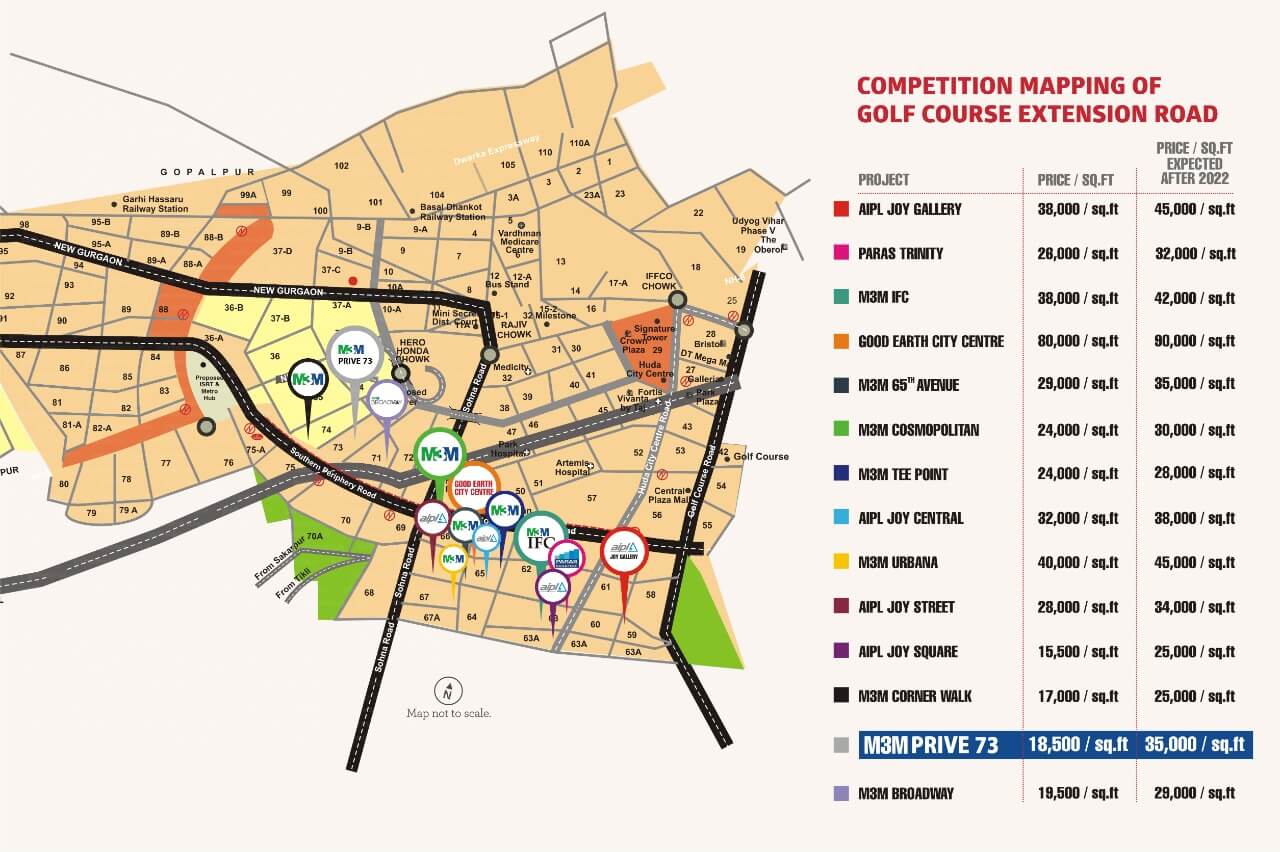

Top 3 retail properties in Gurgaon:

1- Aipl Joy Central

2- Aipl Joy Street

3- M3M 65- Avenue

Top 3 residential properties in Gurgaon:

1- Aipl Club Residency

2- Raheja Aranya

3- Tata Lavida

To know about the best investment for you, consult Golden Bricks: 9555330330 | www.goldenbrics.in