Commercial investment strategy

Commercial Property Investment

Investments are always to be done the right way, for the amount is huge and you would not want such great amounts to go in vain or regulate no returns.

The prime motive of investments is in concern with the returns, every investor wants a higher ROI, but what he often lacks is the strategy of investing in the right way. Here are the way and the strategy to educate people to do it right, because there is no thumb-rule when it comes to property investment.

The basic essence

The first and foremost thing you should take notes about is about debts. You need to make sure you do not have any debts before even thinking about investment. This should be after you own a house and all your dues on the house are clear and you also have gathered enough money to pay off each and every debt. You need to sort a few other things down the lane of property investments and they are – you need to know your requirements and your aim for creating the property investment.

The moment you have dodged all the above-mentioned barriers, you are good to move further and have an insight into the strategy. Here is how you can create a line-up of great real estate portfolio, with a higher return on investment.

- Always invest in income-generating properties

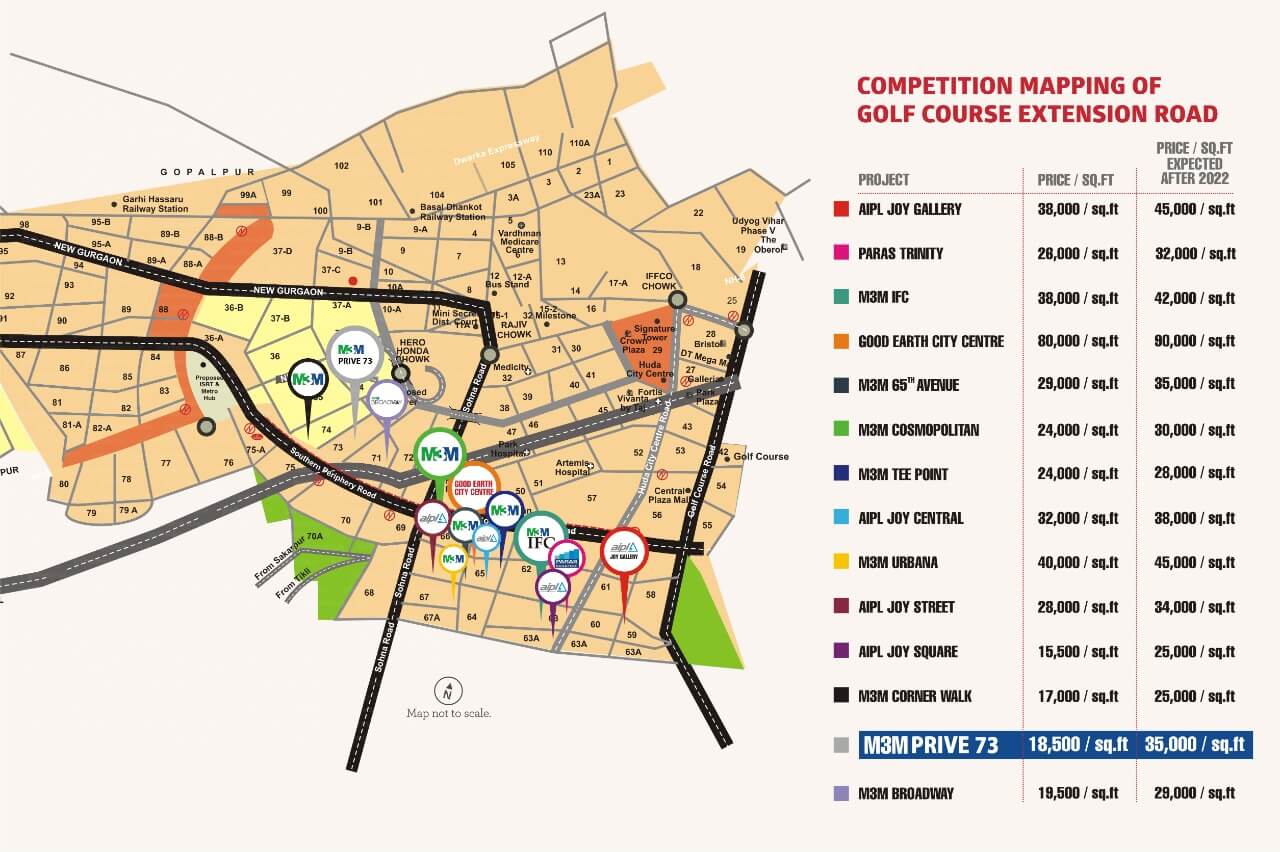

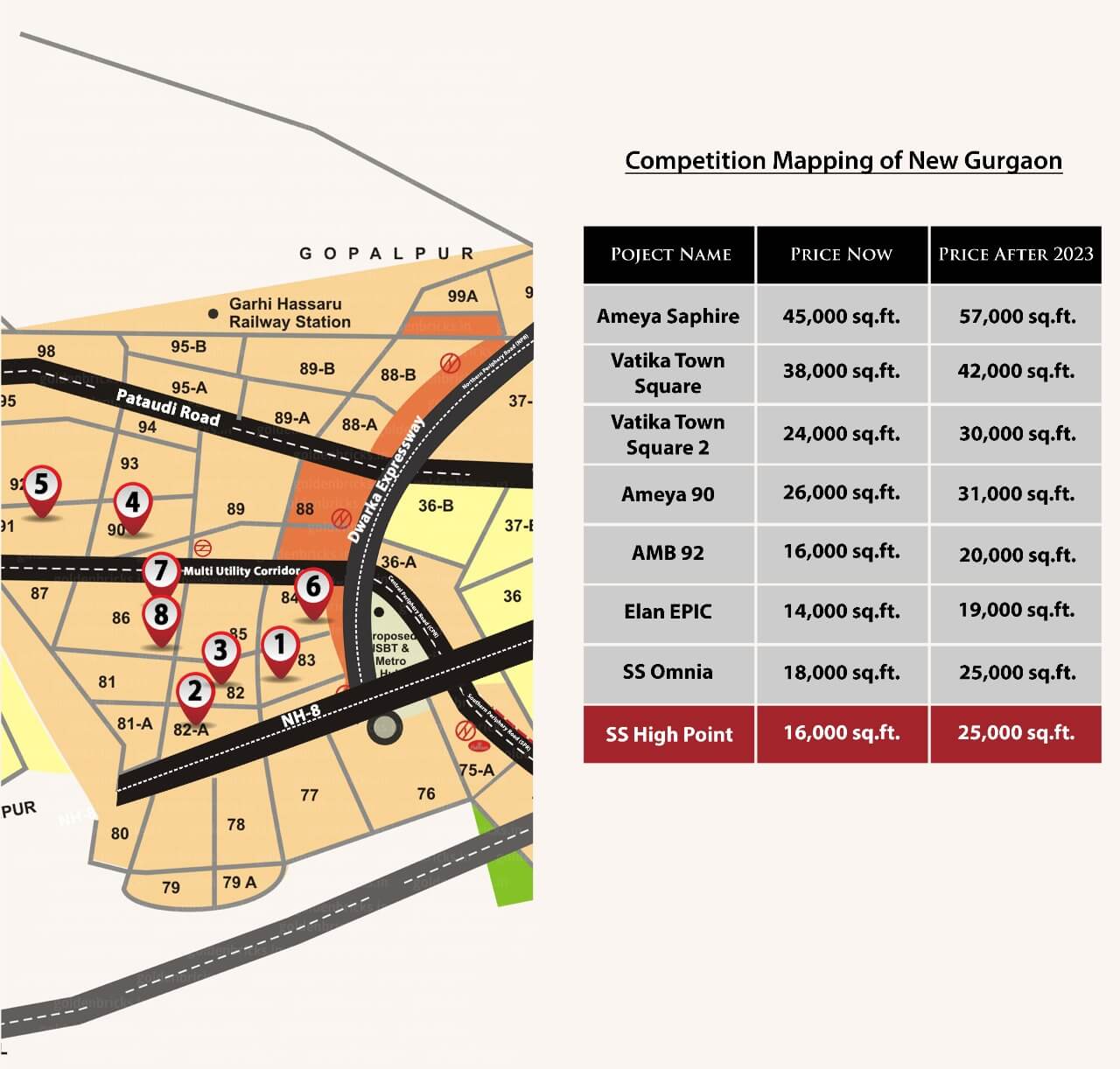

This strategy is contradictory to the myth which says that you must buy a property that has a higher chance of appreciation and wait for it eventually. The present times are all about investing in income-generating properties, appreciation is forever going to remain constant. If you aim at appreciation, the return is going to be less and would consume a lot of time. Otherwise, income-generating properties will give you a constant income throughout the year, appreciation being an addition. In short, it is not the appreciation you must focus on, it is the cash flow you must aim at because the economy is booming and appreciation is an obvious thing.

- Residential homes are not for investors

Here we break the walls to another myth which is that buying an apartment is the right way to invest. You must focus on the income generating properties, and not precisely an apartment and believe it or not, the highest return on investments has been found to have been generated from commercial properties. The choice of option rests upon you, and you may invest in either a retail shop or an office space or a service property as per your perspective, and this is a better way of creating rental income, i.e. commercial properties. Do not buy a second house, rather buy a commercial property.

- Use the bank loans the right way

The actual catch here is to aim for a property that will generate an average of 11 to 12% of the return. If you are obvious you will be earning the expected percentage, you may buy the property against a bank loan of 15 years mortgage, which would charge you an interest of 8%. This way you may pay back the money to the bank and will be left with addition of a minimum of 3% to keep it with you. Appreciation is an obvious thing.

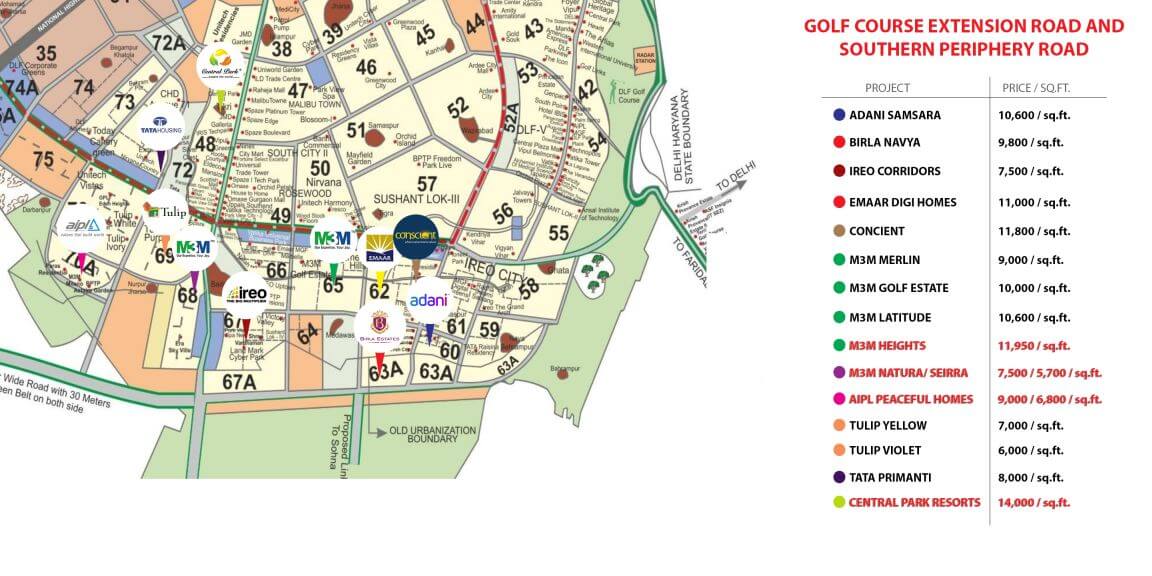

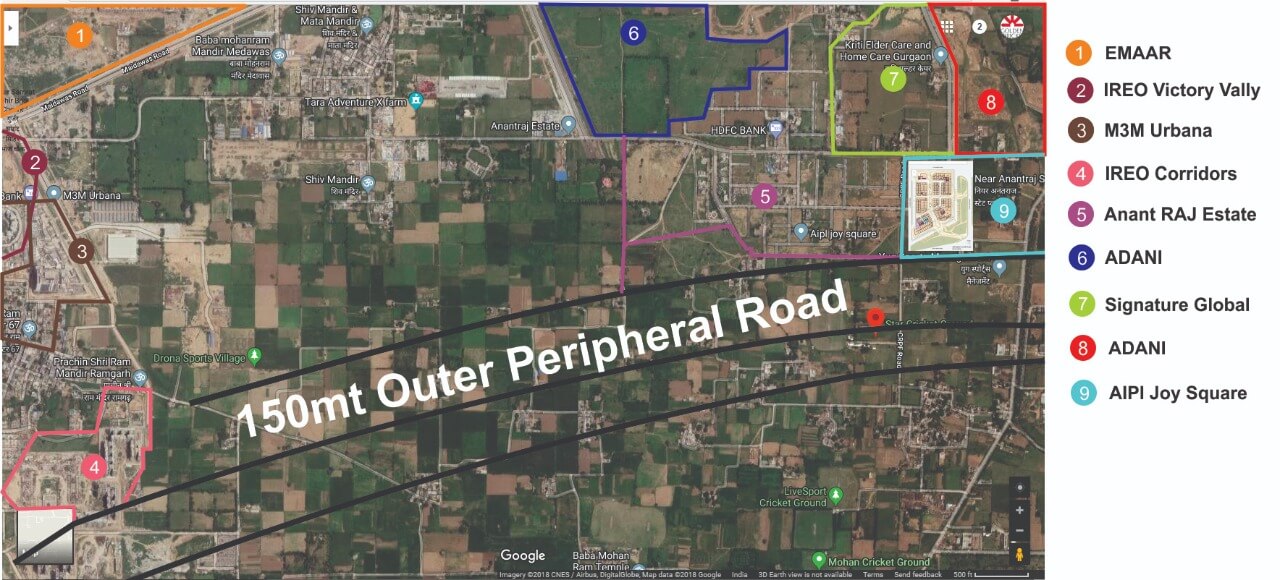

- The location you are investing in

The location is referred to here is not the cities, which people generally assume the metro cities like Kolkata, Delhi, Mumbai, Chennai, Bangalore, Hyderabad, etc. Location here is being referred to as the area or the locality. Make sure you focus on properties belonging to A developers and are located in an area that has tons of employment opportunities around it. Lastly, the infrastructure must also be taken into consideration.

To know more about Commercial Property Investment, call now: +91-9555-330-330 or email: care@wp.goldenbricks.in