Impact of GST on Real Estate Sector

The Goods and Services Tax came in the frame on 1st July 2017, and is seen as a reform in the previous taxation arrangements, proposed to untangle and simplify the system.

The Goods and Services Tax came in the frame on 1st July 2017, and is seen as a reform in the previous taxation arrangements, proposed to untangle and simplify the system.

This might come as a shock to you, but makes absolute commercial sense! Even though residential investments have been considered safe and income-generating for a long time now

Despite the cyclical ups and downs in the real estate market, the investment in real estate sector remains the best investment out of various other options including equity, gold, and other financial instruments.

Gone are the days when real estate projects were out of bounds for most of the people and only those with deep pockets were able to afford it.

Long term income generation is a goal for many. Thus, the instruments that favour this, come in picture. One of such instruments is income generating real estate assets!

As the country switches to GST from July 1, the new indirect tax regime will subsume nearly a dozen of central and state taxes, including excise duty, value-added tax (VAT) and service tax.

The latest study by Numbeo, avowedly the world’s largest database provider of current and timely information on world living conditions including cost of living

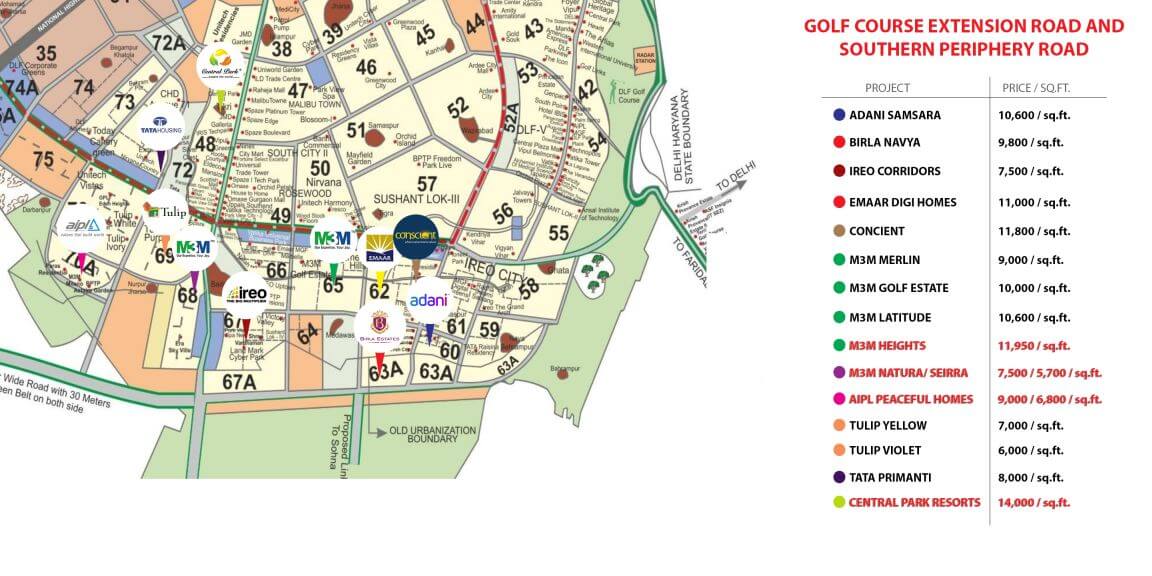

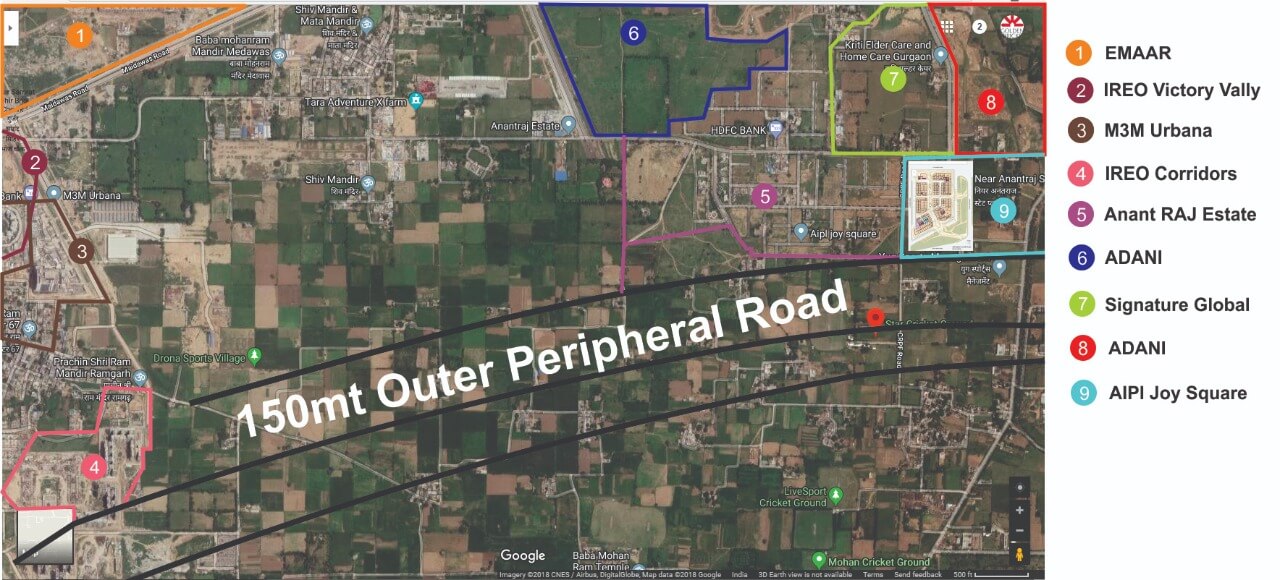

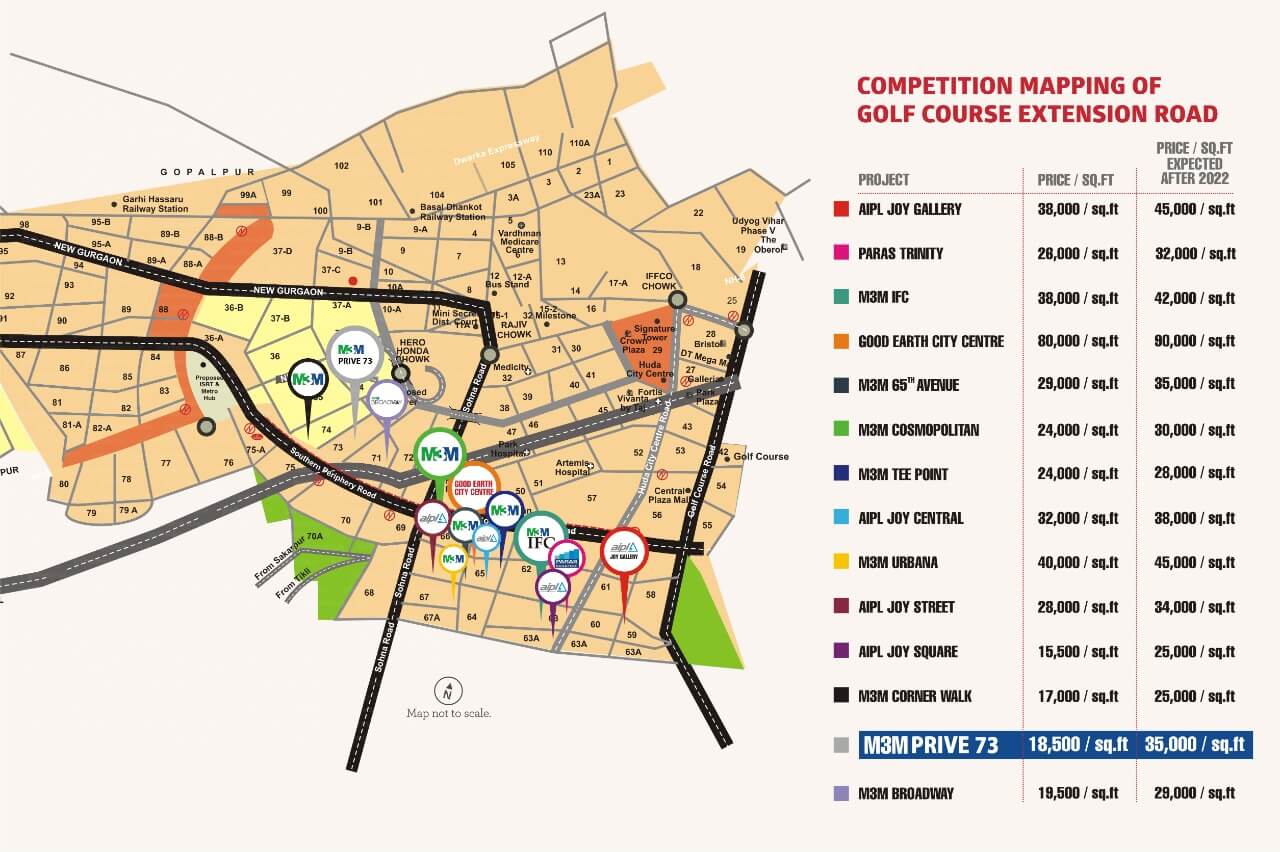

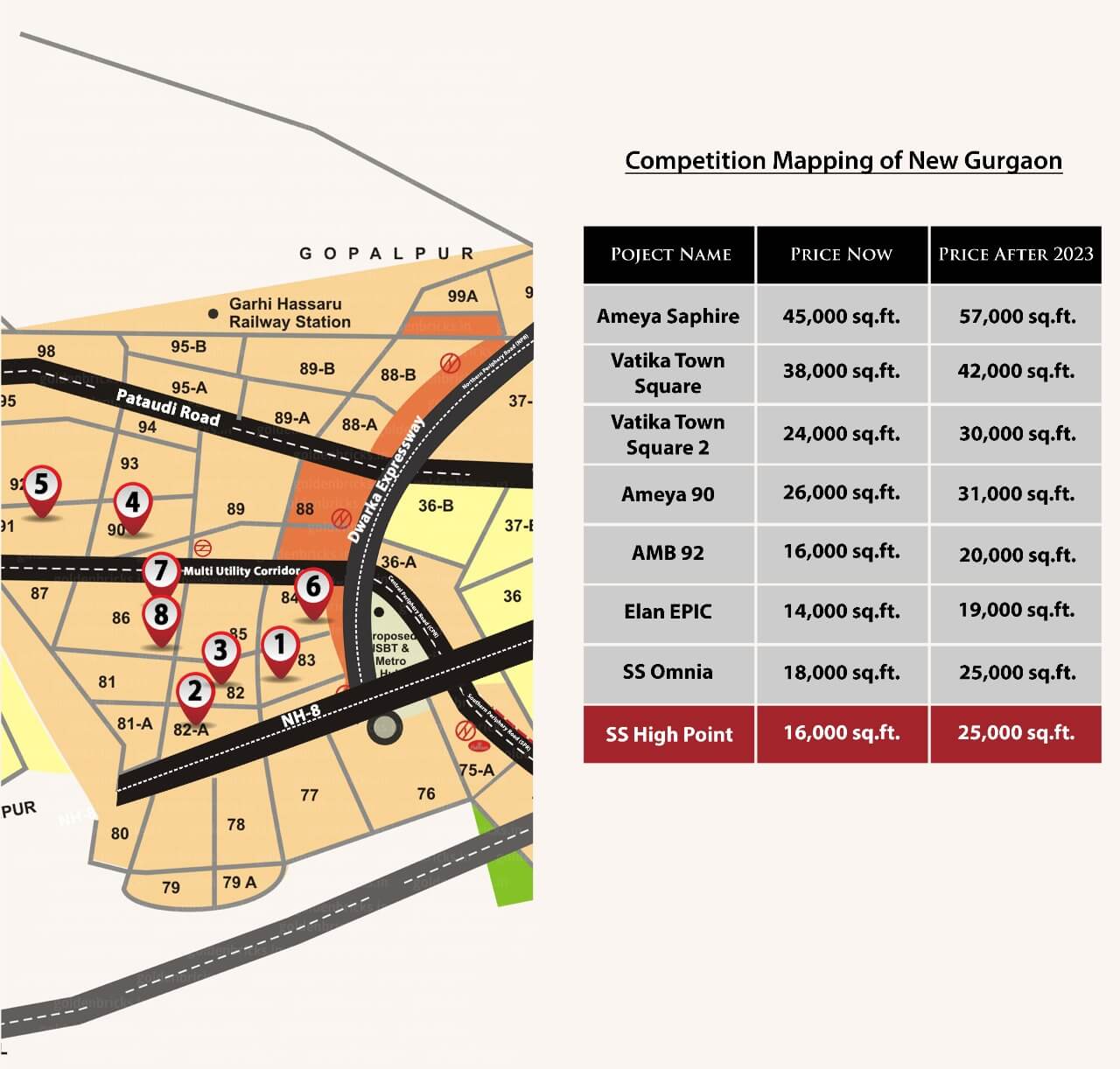

Currently, it provides easy connectivity to Golf Course Road and Sohna along with International Airport and soon it will be connected to Gurgaon-Faridabad Road.

Owing to its accelerated growth with influx of biggest of the multinational corporations and improvement in infrastructure due to government’s policy..

Demonetisation did rattle the real estate market initially, but 6 months down the line, all that can be seen is hope and positive prospects..